Business

More Woes For Nigerians As Marketers Predict Fresh Fuel Price Hike

Some marketers have predicted that the per litre price of Premium Motor Spirit (PMS), better known as fuel or petrol, may go up again soon.

Naija News reports that this will bring more woes on Nigerians as the citizens are yet to recover from the increase in the price of commodities and transportation following the recent hike in the petrol price by the Nigerian National Petroleum Corporation (NNPC) Limited.

Sources in the oil business confirmed to journalists during the weekend that there are strong indications that the pump price of petrol is expected to record another round of increases, the third within ten weeks.

According to the sources, the landing cost of petrol has risen month-on-month, MoM, by 37.4 per cent to N632.17 per litre in July 2023 from N460 per litre in June 2023.

The landing cost excludes other additional costs, which include deport-related charges, transportation logistics and marketers’ margin, which would combine to bring delivery at filling stations at nearly N700/litre.

One of the sources, who reportedly spoke with Vanguard, confirmed that the landing cost for August is expected to rise further as the factors that propelled the rise in July figures have worsened as of last week.

Naija News understands that foreign exchange has been a major concern where scarcity has persisted while the exchange rate has also continued to deteriorate.

There is no certainty that the fuel price will be stable for a long while, especially since the removal of fuel subsidies by the Nigerian government.

Based on reports, Naira as of last weekend, depreciated by about 6.5 per cent in the official market and 25 per cent in the parallel market since the last pump price raise.

The marketers also noted that the cost of fuel import is rising in response to the recent rises in the price of crude oil in the international market.

A transactional analysis of a major operator sighted by journalists last weekend showed that marketers were paying N604.14 per litre as a total direct cost.

A breakdown shows product cost per litre at N578.46, freight (Lome-Lagos) at N10.37, port charges at N7.37, NMDPRA levy of N4.47, storage cost at N2.58, Marine insurance cost at N0.47, fendering cost at N0.36 and ”others” at N0.05 as well as a finance cost amounting to N28.04.

Specifically, the transactional analysis put the landing cost of 28,000 metric tons of imported petrol at over $25 million, including total product cost, total direct cost, and total finance cost, capable of generating more than N22 billion as sales revenue, indicating a loss of over N1.6 billion.

As a result of this development, the marketers said it would be unprofitable to import at the current pump price, while the government has not guaranteed a free float of pump prices.

Consequently, the Nigerian National Petroleum Company Limited, NNPCL, has remained the only importer aside from the minor private importation recorded last month.

The situation appears to be worsening as Nigeria’s crude oil output is now declining, threatening the capacity to import refined products.

In its August 2023 Monthly Oil Market Report, MOMR, obtained by Financial Vanguard, the Organisation of Petroleum Exporting Countries, OPEC, noted the dwindling output of many nations, adding that Nigeria’s oil production dropped on a year-on-year, YoY, basis by 6.5 per cent to 1.26 million barrels per day, bpd in July 2023, from 1.2 million bpd recorded in the corresponding period of 2022.

It also noted that on a month-on-month MoM basis, the nation’s output dropped by 3.0 per cent to 1.26 million bpd in July 2023 from 1.3 million bpd in June 2023.

Nigerians Will Pay More For Fuel

Speaking during an interview during the weekend, the National Operations Controller of the Independent Petroleum Marketers Association of Nigeria (IPMAN), Mike Osatuyi, told journalists that Nigerians would have to pay more for fuel in the next few days.

He said: “It is good because the high crude oil prices mean additional revenue to the federal government. The revenue would likely be used to fund projects and programmes because the government is no more involved in the payment of fuel subsidy.

“But Nigerians will have to pay more for fuel, which prices have been deregulated. The prices are currently high, but we are optimistic that the prices will fall as a result of competition in future.”

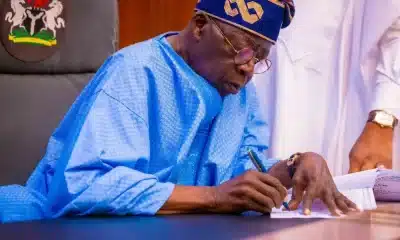

Tinubu Should Intervene On Nigeria’s Foreign Exchange

The Managing Director of a major operator, who also spoke to Vanguard on condition of anonymity, told the publication that the instability and volatility being experienced now in the downstream sector had discouraged not only importation but also massive investment expected of a deregulated market.

He urged President Bola Tinubu to intervene in the management of the nation’s foreign exchange in order to rescue deregulation and the nation’s downstream sector from confusion, stagnation and eventual collapse.

“We have gotten to a point where President Bola Tinubu’s intervention is inevitable. Even if we have the resources to import, we cannot be very sure at what price the product would be sold. So, it is better to hold on and see the way things would unfold in the coming months,” the source said.