Business

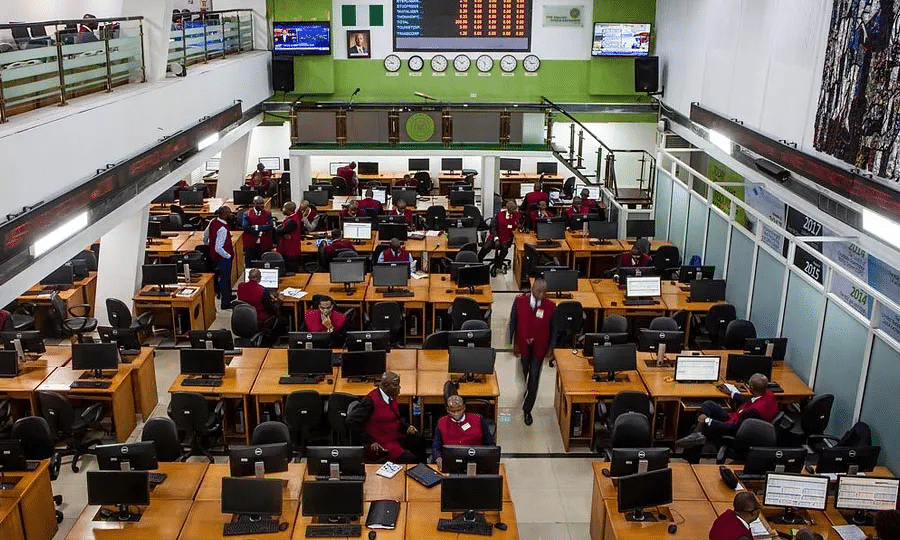

Concerns For Investors As NGX Commence 2024 With N638 Billion Loss

The Nigerian Exchange Limited (NGX) started the year with a loss as investors experienced a decline in market capitalisation for the first time in 2024.

At the end of trading on Wednesday, the market cap decreased by approximately N638 billion, settling at N44.885tn, Naija News understands.

This occurred just a day after the market cap surpassed the N45tn mark.

However, despite the fact that the All-Share Index, the exchange’s benchmark index, remained above 80,000 points, it dropped by 1,167.46 points or 1.40%, closing at 82,024.38 on Wednesday.

The depreciation had an impact on banking stocks, with most of them experiencing losses, except for Jaiz Bank, which defied the trend and appreciated by 5.40% to N2.93, and Stanbic IBTC Holdings, which remained unchanged.

Furthermore, the market capitalisation of Access Holdings Plc and First Bank of Nigeria Holdings fell below N1tn, just a day after surpassing this milestone. They concluded the market session with capitalisations of N989bn and N926bn, respectively.

The decline in the stock market occurred the day after the Economic and Financial Crimes Commission (EFCC) interrogated the Managing Directors of certain banks regarding a fraud discovered at the Ministry of Humanitarian Affairs and Poverty Alleviation.

The main drivers of the market on that day were the stocks of Transnational Corporation Plc, AccessCorp, United Bank for Africa, Jaiz Bank, and Zenith Bank.

The Market Breadth, which indicates investors’ sentiment, was negative, resulting in 13 gainers and 61 losers.

The gainers were primarily led by Cadbury Plc, whose stocks increased by 9.92% to N19.95 per unit. On Tuesday, the consumer goods company announced its intention to seek shareholders’ approval to convert a N7.036bn loan from its parent company, Cadbury Schweppes Overseas Limited, into equity.

In a statement explaining the proposed debt-to-equity conversion filed with the NGX, the company disclosed that between February 2021 and September 2023, Cadbury Schweppes Overseas loaned $23m to Cadbury Nigeria to assist in settling outstanding third-party loans used to finance its raw material imports and other input costs.

However, as a result of the currency exchange difficulties in the nation, it was unable to fulfil its financial obligations, prompting the board to propose a plan to convert debt into equity.

Other companies that experienced gains include VeritasKap, which saw a 9.76% increase and closed at N0.45; Linkage Assurance, with an 8.70% gain and closing at N1.50; Transcorp Hotel, with a 7.24% increase and closing at N100 per unit, and Prestige Assurance with a 6% gain and closing at N0.53 per unit.

On the other hand, the companies that suffered losses were Chams Holdings, Cornerstone Insurance, FTN Cocoa, May & Baker, Caverton, and Consolidated Hallmark Holding Plc. Each of these companies experienced a 10% decrease and closed at N2.16, N1.80, N1.98, N5.49, N2.07, and N1.35 per unit, respectively.

The stocks of Transcorp, AccessCorp, and Guaranty Trust Holding Company Plc were the main drivers of the market trend in terms of volume and value.

Despite the market downturn, the transaction volume for the day increased to 1,641.28 million units of shares, compared to the previous day’s volume of 1,409.85 million units. These shares were valued at N25.37bn and were traded in 20,223 deals. The total number of stocks traded on Wednesday was 123.