Business

Forex Crisis: Nigerians Should Brace Up For New Price Regime, As Fuel Might Sell For N720/litre

Nigerians have been told to brace for a new pricing regime for Premium Motor Spirit, popularly called petrol, in the coming weeks.

This is due to the ongoing forex crisis, as the naira is selling at over 945/dollar at the parallel market on Friday.

Oil marketers on Sunday revealed that petrol might sell between N680/litre and N720/litre in the coming weeks should the dollar continue to trade from N910 to N950 at the parallel market.

Marketers said the CBN Importers and Exporters’ official window for foreign exchange, which boasts of a lower exchange rate of about $740/litre, had remained illiquid and unable to provide the $25m to $30m required for the importation of PMS by dealers.

Marketers told The Punch that the development had led to the suspension of petrol importation by dealers who were initially eager to import the commodity, Naija News learned.

They cited the case of Emadeb, who imported the product and now finding it recoup its investment due to the depreciation of the naira.

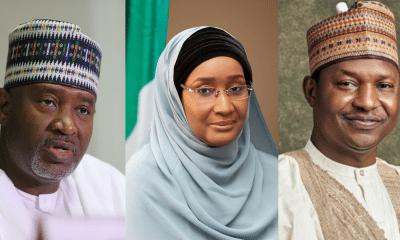

Leaders of the Major Oil Marketers Association of Nigeria and Independent Petroleum Marketers Association of Nigeria, and Petroleum Products Retail Outlets Owners Association of Nigeria have called on the federal government to arrest the forex issues, or else petrol prices go up unless local currency appreciates in the coming weeks.

The National Public Relations Officer, Independent Petroleum Marketers Association of Nigeria (IPMAN) Chief Chinedu Ukadike, observed that the fluctuations in forex now drove the price of petrol; hence Nigerians should expect a hike soon.

Regarding whether oil marketers will hike prices soon, Ukadike submitted that “Once there is slack in the naira against the dollar, there is going to be an effect. The demand and supply of forex is a key factor. We should also understand that it is not only petroleum products that use forex.

“Other manufacturers who import one thing or the other are also searching for dollars. So, the surge for dollars has continued to increase. So now that the dollar is hitting N910 to N940 and approaching ₦1,000, you should expect to buy PMS at the rate of N750/litre.

“It is simple mathematics; once the dollar is going up, have it in mind that the prices of petroleum products would definitely increase because the products are dollar-driven.

“Nigerians should brace for a price regime of between N680 to N720 if the exchange rate stays around N910 to N950/$, but the price is going to hit N750 once the dollar rises to ₦1,000

“This is because marketers still source dollars from the parallel market, and not only marketers but virtually all importers in Nigeria. There is no subsidy anymore on petroleum products, so you expect the cost to fluctuate with the dollars.”

The IPMAN official pointed out that the Nigerian National Petroleum Company Limited (NNPCL) was still the major importer of petrol into Nigeria.

“NNPC is still the major importer for now. One other company, Emadeb, imported products recently, but because this product is being sold in naira, getting back their funds is another issue since the naira keeps depreciating, while PMS imports is in dollars.

“This is why it is often difficult to go back and buy again as an independent importer. That is the problem we are facing,” Ukadike stated.

He said when Nigerians would start seeing the price increase, “NNPC is like the sole distributor of petroleum products now, so once you see a change in the price of petrol at their outlets, other marketers will implement it.”