Nigeria News

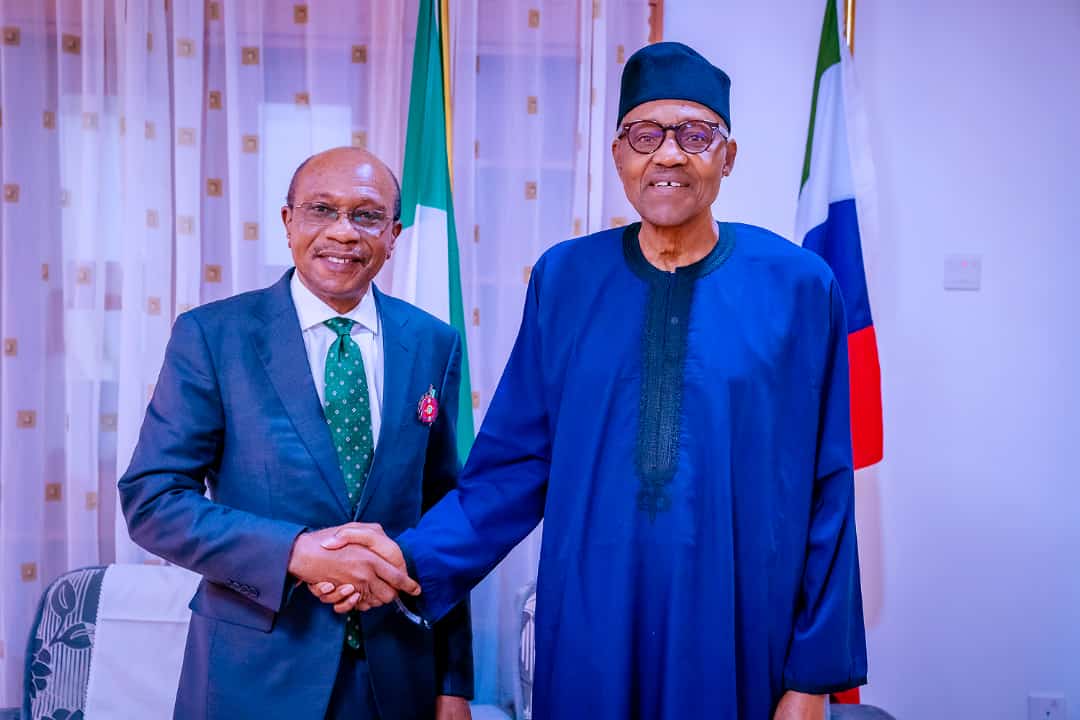

Details Of CBN Governor’s Meeting With President Buhari Emerge

The Central Bank of Nigeria (CBN) Governor, Godwin Emefiele on Thursday noted that the implementation of the cashless policy can not be reversed.

This is coming after the House of Representatives directed the CBN Governor to suspend the implementation of the policy pending.

Lawmakers in the house had summoned Emefiele to come and explain the new policy put in place by the apex bank.

CBN on Tuesday had limited over-the-counter cash withdrawals by individuals and corporate entities to N100,000 and N500,000 per week, respectively.

Emefiele, while addressing State House reporters after meeting with President Muhammadu Buhari in Daura, Katsina State on Thursday, said a lot of electronic channels had been put in place in 10 years since the cashless policy was launched in 2012.

The CBN Governor further stated that the cashless policy had been stepped down on several occasions to fully prepare for the implementation of the policy and deepen payment system infrastructure in Nigeria.

Emefiele said, “I can only just assure you that it will go round, let us just be calm, luckily the old currency continued to be legal tender till January 31, 2023. So, I want to crack a joke, both the painted (new notes) and unpainted (old notes) will operate concurrently as legal tender. But by January 31, the unpainted one will not be useful to you again, so please take it to your bank as quickly as possible.”

Emefiele said about N1 trillion of the old notes had been returned to the banking system.

Speaking on what the apex bank will do about the police, Emefiele said, “The Senate of the Federal Republic is National Assembly, they are the legislative arm of the government and from time to time we brief them about what is happening and about our policies and I am aware that they have asked for some briefings and we will brief them.

“Having 1.4 million of them is as good as having 1.4 million banking points where people can conduct services. And we think Nigeria is a big country, the biggest economy in Africa that we need to leapfrog into the cashless economy. We cannot continue to allow a situation where over 85 per cent of the cash that is in circulation is outside the bank. More and more countries that are embracing digitization have gone into cashless.

“And I said it at different fora, that this is not targeted at anybody, it is just meant for the good and development of the Nigerian economy and we can only continue to appeal to Nigerians to please see this policy the way we have presented it. We will be reviewing from time to time how this is working because I cannot say that we are going to be rigid. But it is not to say that we will reverse, it is not to say that we will change the timing, but whether it is about tricking some amount to be a little bit higher or a little bit lower, and all the rest of them.

“We will do so because we are humans, we want to make sure that we are making life good for our people. We do not want to make life difficult for them. So, there is no need for anybody to worry, the central bank is monitoring what is happening and I can assure everyone that we are up and alive to our responsibilities and we will do what is right for Nigeria and Nigerians.”