Business

CBN Disburses N1tn To Anchor Borrowers Programme Farmers

The Federal Government has launched five strategic policy reports with a view to actualizing 95 per cent financial inclusion by 2024.

Meanwhile, the Central Bank of Nigeria has disbursed N1.07tn to farmers under the Anchor Borrowers Programme. This was disclosed by the bank’s communiqué no 145 released after its recent Monetary Policy Committee meeting in Abuja.

The reports launched at the ongoing International Financial Inclusion Conference in Abuja on Thursday were: Revised National Financial Inclusion Strategy; National Strategy for Leveraging Agent Networks for Women’s Financial Inclusion; National Fintech Strategy and Nigeria Financial Services Maps (NFSMaps); and Payment System Vision 2025

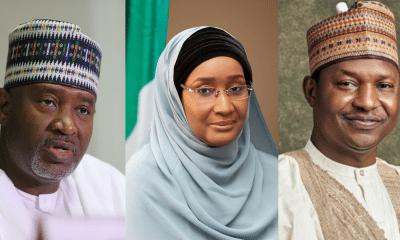

While speaking at the event, President Muhammadu Buhari explained that his administration took into cognizance the importance of financial inclusion on economic growth and development, considering that they provided the enabling policy environment to achieve the expected results.

The president, who was represented by the Federal Capital Territory Minister, Mohammed Bello, said: “For instance, in 2019, I launched the Micro Pension policy which was aimed at deepening pension penetration amongst M.S.M.E.s and the informal economy. We also initiated policies for Micro-Insurance and Collective Investment. These initiatives are geared toward providing access to a wide range of financial products and services to the underserved in line with our National Financial Inclusion objective.”

Buhari explained that financial inclusion has being a major innovative solution for dealing with some of the pressing issues facing the country.

He stated that in order to increase financial services access points in underserved locations in the country, the Central Bank of Nigeria had issued the Payment Service Bank regulatory framework.