Nigeria News

Naira Redesign: Emefiele, Ex-Finance Minister Have Questions To Answer – Yuguda

A former Governor of Bauchi State, Isa Yuguda, has said the suspended Governor of the Central Bank of Nigeria CBN), Godwin Emefiele, and the immediate past Minister of Finance, Budget, and National Planning, Zainab Ahmed, have questions to answer regarding the naira redesign policy.

Recall that the suspended CBN governor had announced that the apex bank had redesigned some naira notes in the denomination of N200, N500, and N1000 in line with the provisions of the CBN Act 2007.

After the announcement of the development, some Nigerians and financial experts slammed Emefiele for the naira redesign policy, stressing that the redesigning of the banknotes portends serious consequences for the economy.

But according to Yuguda, the former Finance Minister cannot feign ignorance about the operations and activities of the apex bank under Emefiele, even though there is an Act that guides the CBN.

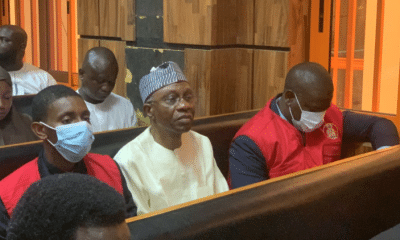

The former Bauchi governor stated this during an interview on Channels Television’s Sunrise Daily on Monday while reacting to the suspension of Emefiele and his arrest by the Department of State Services (DSS).

Yuguda said Ahmed should have advised former President Muhammadu Buhari that the country’s debt profile is worrisome and foreign borrowings should have been reduced.

Ahmed Condemns CBN’s Naira Redesign

Recall that the former minister had on October 28, 2022, stated that the ministry was not consulted before the CBN decided to redesign some naira notes.

Speaking during the 2023 budget defence session with the Senate Committee on Finance, Ahmed said the naira redesign portends serious consequences for the economy, adding that such decisions require rigorous economic planning.

She said part of the reasons the CBN gave for taking the step was the mopping up of liquidity to manage inflation, stressing there will be both benefits and consequences for the policy.

She had said: “We were not consulted. It was an announcement that we heard.

“We are also looking at what the consequences will be. There will be some benefits but there are some challenges. I don’t know if the monetary authorities have looked very closely at what the consequences are and how they can be mitigated.

“I still advise that you have that discussion with the monetary authority.”