Business

Experts Kick Against ASUU’s Proposed 10% Education Tax, Make Case For Private Firms

The Academic Staff Union of Universities (ASUU) has been criticized by tax experts over the proposed hike in tertiary education tax in the country.

Naija News gathered that these experts have kicked against the proposed increase of the tertiary education tax from three percent to 10 percent saying the move would only put more burden on private firms.

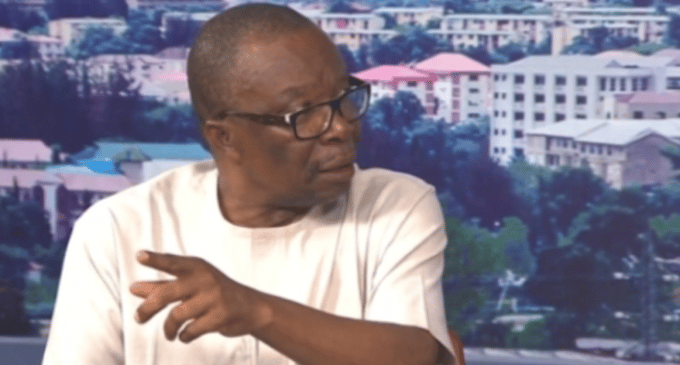

Fiscal Policy Partner and Africa Tax Leader of the PwC, Taiwo Oyedele, faulted ASUU’s move saying there was just an increase in education tax a year ago.

Oyedele, who was featured on an Arise TV interview said the increased education tax rate would be one of the highest in the world, noting that for a sector where investors are needed.

He explained that one basis point of the education tax rate is equivalent to two basis points of companies income tax rate because it is calculated on a much larger base than companies income tax.

Oyedele argued that when companies’ income tax, technology tax, police tax, and science and engineering tax, among others, were computed, a firm would effectively be paying over 40% tax which he said is too high.

He said, “And based on the 2022 Finance Bill, there is a proposal to take it to three per cent from 2.5 per cent. For those of us who are involved in tax matters, I can tell you authoritatively that one basis point of the education tax rate is equivalent to two basis points of companies income tax rate because it is calculated on a much larger base than companies income tax.

“This is one of the highest in the world for a country where you need to attract investments. It is even higher than the OECD. The problem that we have in the educational sector is not by increasing the burden on the private sector to fund them. The fundamental question is that over the last 10 years, education tax has contributed over N2tn to that sector. Who is explaining how that money has been spent?”

Naija News understands his reaction is a sequel to the recently proposed increment in the tertiary education tax by the ASUU president Prof Emmanuel Osedeke.

Osedeke, who was recently featured on Arise TV interview was reported to have proposed that the tax should be raised to 10% from 3 % to enable better funding for infrastructure in Nigeria’s universities.

He submitted that “In 1992 when we had a disagreement with the government, the government said we should look for other ways of getting funding. That was how TETfund came. This time around, the government is saying there is no money to fund it and it is talking about using tuition to raise money. How will a man earning N30,000 be able to afford it? Why not take 10 per cent of big companies and inject into the education system so that you have a better and free country?”

However, the ASUU president’s proposal wasn’t a welcomed idea as tax some experts have described it as a dead-on-arrival move.

Also reacting to the development, the Chief Executive Officer of the Financial Derivatives Company, Bismark Rewane submitted that Osedeke’s proposal was coming at the wrong moment, querying what has been achieved with the already paid ones.

He said, “That is another knee-jerk reaction with all due respect to ASUU. What have we achieved with the 2.5 per cent Tertiary Education Tax? We should look at how utilisation of tax proceeds has been as well as its impact.”

He opined that monies saved from subsidies should be deployed almost totally to funding education.