Business

Nigerian Government Settles CBN Debt, Boosts Investor Confidence

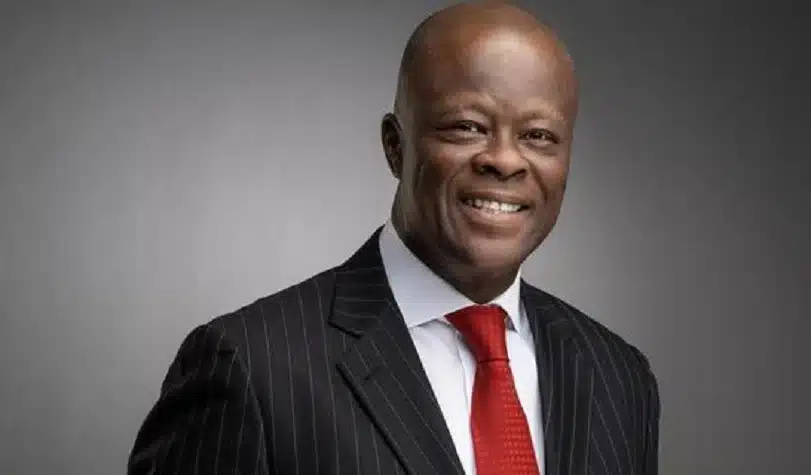

The Minister of Finance, Wale Edun, announced the allocation of N4.83 trillion from Treasury Bills and Bonds to settle the outstanding Central Bank of Nigeria (CBN) debt.

This strategic move, revealed during a presentation at the Lagos Business School Breakfast Club, marks a shift towards using public domestic debt instruments to manage and service existing financial obligations. In 2023, the government had obtained N2.94 trillion from the CBN, showcasing a proactive approach in financial management.

Investor Attraction and Economic Stability

The government’s financial instruments, particularly NTBs and Bonds, have witnessed increased demand from investors, driven by the CBN’s attractive interest rates and strong defense of the naira. Minister Edun highlighted the enormous interest payout expected, with the CBN incurring about N1.01 trillion.

The first quarter of 2024 saw a total subscription for government securities reaching N21.17 trillion, indicating a rebound in investor confidence and demand for Nigerian financial assets.

Fiscal Management and External Debt Servicing

The Ways and Means provision, a financial mechanism allowing short-term funding from the CBN, was significantly utilized, with the National Assembly securitizing N22.7 trillion of such advances. This fiscal maneuver is part of Nigeria’s broader strategy to manage cash shortfalls and external debt obligations efficiently.

The increase in external debt servicing, as reported by the Debt Management Office, underscores the government’s commitment to fulfilling its international financial commitments.