Nigeria News

Wale Edun Reveals Two Strategies Govt Is Using To Combat Foreign Exchange Shortage

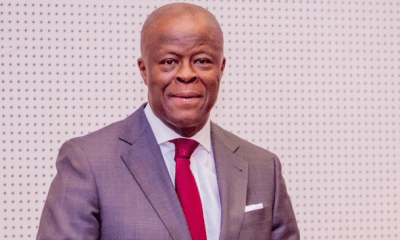

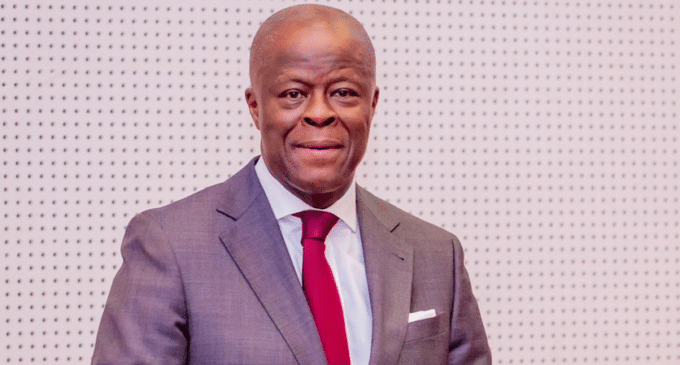

The Minister of Finance and Coordinating Minister for the Economy, Wale Edun has shed more light on the strategy being applied by the Federal Government to combat foreign exchange shortage.

Edun disclosed that the two-pronged strategy was hinged on attracting foreign investors and boosting government revenue.

He disclosed this in a podcast, “BC Advisory Dialogue” hosted in Abuja by Bruit Costaud in collaboration with Ballard Partners.

According to Edun, the Central Bank of Nigeria (CBN) shifted its focus from development funding to tackling inflation, a move the government believes is essential for economic stability.

Edun said, “With inflation high and government borrowing rates low, the government raised its own interest rates on bonds. This higher interest rate attracted foreign investors seeking better returns, and they in turn injected much-needed United States (U.S.) dollars into the local economy.

“The CBN indicated that they were stepping back from intervention funds or development financing, and they were focusing on their core mandate fighting inflation because without inflation coming down you can’t have a stable economic environment and CBN signalled that they felt that inflation will be on average in 2024 at 21.5 per cent.

“At the time Treasury Bill rates were at 13 per cent and government was selling securities and bonds at the top level around 13 per cent or even lower, way below the targeted rate of inflation; so, the DMO immediately followed that signal and raised their own interest rate and that was by selling more bonds because the more you want to sell, the lower the price you have to accept, the higher the rate you have to be willing to pay and that automatically triggered the interest of foreign portfolio investors and it brought dollar liquidity into the system

“The figures have been announced we all know but that is how that mechanism works and that has brought dollar liquidity which is much needed because there are some outstanding dollar obligations which need to be paid, suggesting that more foreign exchange are on their way into the country.”