Nigeria News

MTN, Dangote, BUA, FBN Holding, Others Lose N1.6 Trillion Over FX Crisis

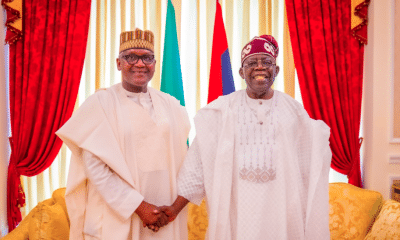

President Bola Tinubu‘s administration in what was initially hailed as a decisive action took the bold steps of scrapping petrol subsidies and unifying Nigeria’s foreign exchange windows, drawing praises globally for showcasing political will.

The former president of the World Bank, David Malpass, lauded these policies as “important steps toward currency stability, lower inflation, and reduced corruption” in Africa’s most populous nation.

However, the anticipated benefits of these reforms have been overshadowed by the tough operating environment they inadvertently created for businesses in Nigeria.

According to TheCable, GlaxoSmithKline (GSK) Consumer Nigeria Plc, a leading drug manufacturer, ceased its operations, pointing to FX challenges as the primary reason.

This move was closely followed by Sanofi-Aventis Nigeria Limited, another pharmaceutical giant, which halted operations three months later, signaling a trend of distress among international and local businesses.

Nearly a year after the implementation of these policies, the promise of a stable naira and an improved cost of living remains unfulfilled.

Inflation is inching closer to the 30 percent mark, exerting additional pressure on the already strained pockets of Nigerians. Despite government efforts to stabilize the economy, the devaluation of the naira has significantly impacted companies’ profit margins, as the local currency plummeted from N461 per dollar in December 2022 to N907 by December 2023.

By March 4, 2024, the exchange rate further deteriorated, with the naira trading at ₦1,534.19/$ in the official window and ₦1,620 in the black market.

The financial performance of companies across various sectors reflects the harsh realities of these economic policies.

The platform revealed that an analysis of the 2023 financial reports reveals that seven organizations suffered combined foreign exchange losses totaling N1.697 trillion, underscoring the depth of the impact on the corporate landscape.

While analysts remain optimistic, projecting a positive outlook for the naira and the broader economy based on recent decisions by the monetary policy committee (MPC) of the central bank, the current financial narratives of key players paint a grim picture.

Here are the seven companies that have reported huge foreign exchange losses last year.

DANGOTE GROUP — N164 BILLION

Dangote Cement, Nigeria’s biggest cement producer, recorded a whopping N2.208 trillion in revenue in 2023, a 36.44 percent increase from N1.618 trillion in 2022.

The cement plant is a subsidiary of the Dangote Group owned by Aliko Dangote, Africa’s richest person.

According to its financial statement, the plant also reported about N1.202 trillion in gross profit in 2023 compared to N955.433 billion in 2022 — a 25.79 percent surge.

On operating profit, the firm saw an increase to N734.267 billion in 2023 — up from N585.876 billion in 2022; and also recorded a profit-after-tax of N455.583 billion from N382.311 billion in 2022.

However, the statement said the group booked a loss of N164.07 billion in 2023 as its total FX loss due to its operations in other countries.

Meanwhile, on January 23, 2024, the market capitalisation of Dangote Cement climbed from the record-breaking N10.09 trillion to over N11 trillion.

BUA CEMENT — N69.9 BILLION

The second-largest cement producer recorded a growth in its profit-after-tax from N360.98 billion in December 2022 to N460 billion in the same month last year, according to the firm’s full-year financial statement.

This, the firm said, is despite its rising input costs caused by unreliable electricity from the grid, shortage of gas supply, and foreign exchange losses due to an abrupt devaluation of the naira.

The company, however, reported an FX loss of N69.96 billion — up from N5.5 billion recorded in 2022.

“The Company is exposed to foreign exchange risk arising from future commercial transactions and some recognised assets and liabilities to the US Dollar and Euro,” BUA Cement said.

“Management minimises the effect of the currency exposure by buying foreign currencies when rates are relatively low and using them to settle bills when due. The company is primarily exposed to the US dollar and Euro.”

BUA Cement reported an FX loss of N69.96 billion

NIGERIAN BREWERIES — N153.3 BILLION

In its audited results for the period ended 31st December 2023, the Nigerian Breweries Plc, recorded a net loss of N106 billion during the year, largely due to the impact of the devaluation of the naira on its foreign exchange transactions.

The report, filed on the Nigerian Exchange Limited (NGX), indicated that the organisation’s revenue rose by 9 percent relative to the same period in 2022.

Nigeria’s brewing giant, however, reported an operating profit of N44.5 billion in 2023 — about 15 percent lower than in 2022.

The firm cited an increase in input cost, a one-off reorganisation cost and other economic pressures as causes of the decline.

The loss drained the company’s equity resources, which shrank from N180 billion in 2022 to N63.3 billion in 2023 — the lowest equity cushion for the company in many years.

In the 2023 financial report, a massive FX loss of N153.3 billion was identified as the key factor driving the brewing company’s losses. This represents a significant increase from the N26.3 billion FX loss reported in 2022.

Nigeria Breweries incurred an FX loss of N153 billion

FIRST BANK OF NIGERIA (FBN) HOLDINGS — N350 BILLION

In the banking industry, FBN Holdings suffered significant net FX losses exceeding N350 billion at the end of December 2023.

The numbers, contained in the unaudited financial report of the bank holding company, show that N253.7 billion net FX losses were recorded in the final quarter alone.

The loss swelled from the N96.7 billion figure at the end of the third quarter (Q3) and a deep plunge from net FX gains of N22.4 billion at the end of 2022.

The report also shows that the bank’s windfall came from net gains on financial instruments — big enough to level up the impact of the FX losses and enable a 127.6 percent lifting of the bottom line to N309.9 billion for the year.

FBN Holdings suffered significant net FX losses exceeding N350 billion

MTN NIGERIA — N740 BILLION

On March 1, 2024, MTN Nigeria released its audited financial statement for 2023 which disclosed that the telecommunication firm took a major financial hit due to changes in Nigeria’s FX market.

The company reported FX losses amounting to N740.4 billion, a massive 804 percent increase compared to the N81.8 billion recorded in 2022.

The bank said the significant jump could be attributed to a policy shift implemented in June 2023 — the liberalisation of the FX market.

The FBN said the change likely resulted in a less controlled exchange rate, potentially leading to a weaker naira.

According to the telco, a total after-tax loss of N137 billion was also recorded.

Despite this, the company said its revenue increased by 22.69 percent to N2.469 trillion in 2023, compared to N2.012 trillion in the previous year.

NESTLE NIGERIA PLC — N195 BILLION

One of Nigeria’s biggest consumer goods companies, Nestle, also reported a profit loss in its full-year operations for 2023.

The firm said its profit-after-tax was negatively impacted by the devaluation of the naira as its operating cost jumped by 41.2 percent to N122.7 billion.

Due to the devaluation of the naira, the company said N195.07 billion FX losses were reported, documenting a profit-after-tax loss of N79.5 billion for 2023.

Despite this, the company said it gained an increase of N100 billion in revenue to make a total of N547.11 billion — up from the N446.81 billion made in 2022.

Nestle added that an upsurge in the company’s gross profit to about N217.2 billion was also recorded, representing a 39.4 percent increase from N155.8 billion in 2022.

Nestle Nigeria reported N195.07 billion as FX losses.

SEPLAT ENERGY — $27.7 MILLION

In the energy sector, the story was not different for Seplat Energy.

The firm, in its 2023 audited financial statement, said its operating profit decreased by 9.2 percent to $249.4 million compared to the $274.7 million achieved in 2022.

The oil company said the decrease in operating profit can be attributed to a “combination of lower oil prices, FX losses due to naira devaluation, and higher general and administrative (G&A) expenses”.

Seplat Energy added that its exchange rate difference resulted in a net (non-cash) loss of $27.7 million, compared to an FX loss of $1.1 million in 2022.

“Overall, there is no adverse effect on the company and summarised in the table below are the expected future impacts of naira devaluations,” the company said.

In the report, the company announced a gross profit of $532.0 million in 2023, which rose by 14.4 percent from the $464.7 million recorded in 2022 and revenue from oil and gas sales for 2023 rose 11.5 percent to $1.06 billion from $952.0 million in 2022.