Business

CBN Injects $500 Million Into Forex Market, Vows To Clear Backlog

The Central Bank of Nigeria (CBN) has injected an additional $500 million into the market with the aim of resolving the ongoing backlog of verified foreign exchange operations.

Naija News reports that this development comes barely a week after the bank sent about $2 billion to settle unfulfilled obligations in the petroleum, aviation, and manufacturing industries.

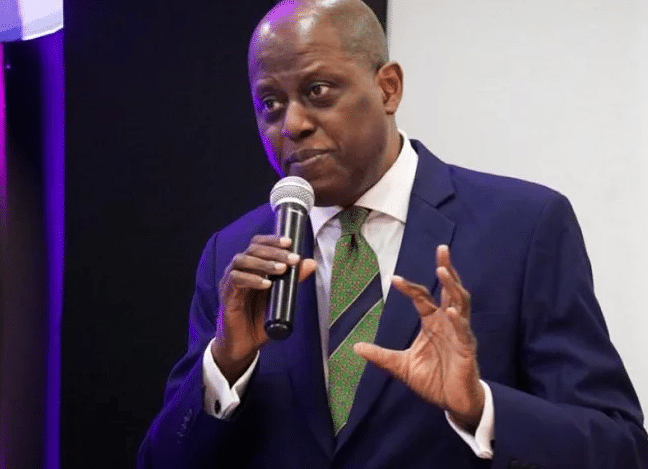

Making this disclosure while speaking in Abuja on Monday, the CBN’s Acting Director of the Corporate Communications Department, Hakama Sidi Ali, detailed that the bank was committed to settling all legitimate forex backlogs within a short time-frame.

According to Sidi Ali, the CBN is putting into practice a comprehensive plan to increase short-, medium-, and long-term liquidity in the Nigerian foreign exchange markets.

The CBN spokeswoman stated that the main goal of this policy is to solve the fundamental problems that have long prevented the Nigerian FX markets from operating efficiently.

She said, “The Management of the CBN is committed to settling all legitimate foreign exchange backlogs within a short time frame.

“As the governor said, the CBN’s focus is on addressing fundamental issues that have hindered the effective operation of the Nigerian FX markets over the years.”

Sidi Ali urged all participants in the forex market to play by the rules, emphasizing that transparency in the market would enable the fair determination of exchange rates and, by extension, guarantee stability for businesses and individuals alike.

She said, “We urge all participants in the market to play by the rules. Transparency in the market will enable the fair determination of exchange rates and, by extension, guarantee stability for businesses and individuals alike.”

The bank has been taking steps to address the currency backlog in recent months, and the CBN’s current action is only one of them.

The CBN has released different amounts over the last few months in an attempt to pay off the outstanding foreign exchange liabilities.

It is hoped that by continuing to intervene, the CBN will contribute to the stabilization of the foreign exchange market and stimulate Nigeria’s economy.

According to Sidi Ali, the reforms to the forex market are intended to eliminate arbitrage opportunities, promote transparency, and simplify and harmonize various currency rates.

She was optimistic that foreign investment would increase and investor confidence would be bolstered by a stable exchange rate.