Business

CBN Exchange Rate For Euro, Pounds And Other Currencies

In a bold attempt to steer Nigeria’s economy towards stability, the Central Bank of Nigeria (CBN), under the leadership of Governor Yemi Cardoso, has embarked on a comprehensive series of reforms and policy adjustments.

These efforts, aimed at stabilizing the naira and restoring its value, have begun to bear fruit, as evidenced by the recent positive trends in the foreign exchange market.

Naija News reports that the CBN’s proactive measures have successfully halted the naira’s freefall, marking a significant turnaround from its low point of 1,900 per dollar in late February to a much-improved rate of nearly 1,200 per dollar at the parallel market as of Tuesday.

Among the key strategies implemented by the CBN is the unification of exchange rate windows, which has eliminated disparities and confusion around currency values.

The liberalisation of the FX market has encouraged a freer flow of foreign exchange, enhancing liquidity and access for businesses and individuals alike.

Further bolstering the nation’s economic framework, the CBN has cleared FX backlog obligations for banks and airlines, addressing delays and financial strain within these critical sectors. The introduction of a Price Verification System and the imposition of limits on banks’ Net Open Positions have fostered greater transparency and risk management within the banking sector.

In a significant move, the daily cap of N2 billion on the remunerable Standing Deposit Facility has been removed, allowing for more flexibility in the management of liquidity. Additionally, the Bureau De Change segment has undergone a comprehensive overhaul to improve regulation and combat misuse.

Highlighting its ongoing commitment to market interventions, the CBN announced on Monday that it had sold dollars to Bureau De Change (BDC) operators, with plans to distribute $10,000 to each BDC at a rate of ₦1,101 per dollar.

Operators are directed to maintain a sale spread not exceeding 1.5 percent above the CBN’s rate, ensuring fair access and pricing for consumers.

This strategy marks a departure from March’s sales, where BDCs received $10,000 at a rate of ₦1,251 per dollar, and were instructed to sell at no more than 1.5 percent above their purchase rate, translating to approximately ₦1,269 per dollar.

The CBN’s latest interventions come on the heels of its decision in February to sell $20,000 to eligible BDCs nationwide, a move that underscored the bank’s aggressive approach to currency stabilization and economic management.

As these reforms take hold, there’s growing optimism among financial analysts and the broader public that the CBN’s strategies will not only stabilize the naira but also lay the groundwork for sustained economic growth. With the naira’s rebound and the implementation of robust financial policies, Nigeria appears to be on a promising path toward economic recovery and stability.

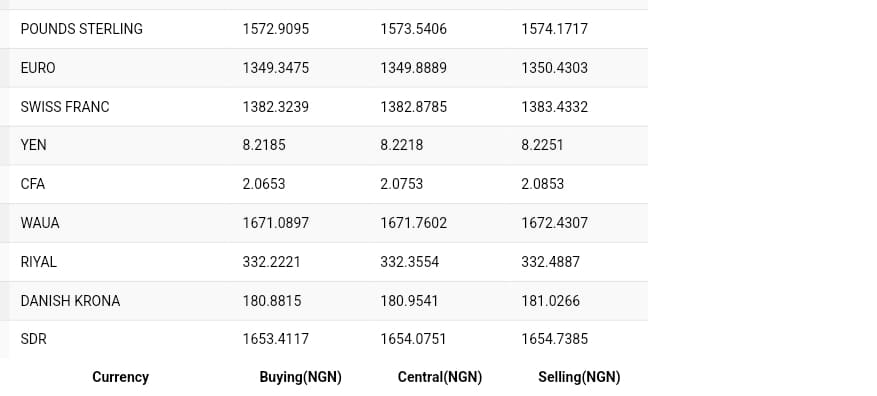

Here is the CBN buying and selling price for Euro, Pounds and other currencies: