Business

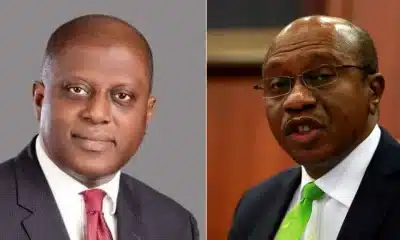

CBN’s Foreign Exchange Measures Yield Positive Results, Attracts $1bn Investment – Cardoso

The Governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, has announced that the apex bank’s strategic interventions in the foreign exchange market have begun to show promising outcomes.

Speaking at a briefing of the Joint Senate Committee on Finance, Banking, Insurance, and Financial Institutions on Friday, Cardoso revealed that the country had seen an inflow of $1 billion into the market, signalling a robust response from foreign investors to the CBN’s policies.

The briefing, which was convened amid growing concerns over the nation’s economic health and the depreciating value of the naira, served as a platform for Cardoso to outline the effects of the CBN’s recent measures on stabilizing the foreign exchange rates. He emphasized the critical relationship between exchange rates and inflation, noting that the bank’s efforts are geared towards minimizing the adverse impacts of high exchange rate fluctuations on the economy.

Cardoso’s remarks come at a crucial time when Nigeria is grappling with inflationary pressures and a volatile foreign exchange market. He pointed out that the positive shift in the market is a clear indication that the CBN’s policies are working as intended, with significant interest from foreign portfolio investors helping to bolster the nation’s foreign exchange reserves.

In addition to attracting foreign investment, the CBN Governor highlighted the importance of improving the US dollar supply to the Nigerian economy. Such measures, he argued, hold significant potential in taming the volatility of the exchange rate, which is instrumental in moderating inflation. However, Cardoso was quick to note that for these measures to have a lasting impact, Nigeria must take steps to moderate its demand for foreign exchange, addressing the root cause of the exchange rate pressures.

In a bid to restore credibility to the Central Bank and tackle the underlying issues affecting the exchange rate, Cardoso assured the committee that the CBN is committed to rigorous economic strategies, including an inflation-targeting framework aimed at reducing inflation to 21.1 per cent this year.

The Senate’s decision to summon the Central Bank Governor on January 31 underscores the urgency of addressing the economic challenges facing Nigeria, with a particular focus on the sharp decline of the naira in the foreign exchange market. Senators are seeking explanations and solutions to the myriad of economic difficulties confronting the country, emphasizing the need for effective policies to stabilize the economy and promote sustainable growth.

As the CBN continues to implement measures aimed at stabilizing the foreign exchange market, the recent influx of $1 billion into the Nigerian economy is a hopeful sign of recovery and a testament to the potential success of the bank’s interventions. The nation now watches closely as these efforts unfold, with the expectation that sustained positive results will lead to a more stable economic environment.