Nigeria News

CBN Announces New Reserve Requirement Structure

The Central Bank of Nigeria (CBN) has implemented a new updated Cash Reserve Requirement (CRR) mechanism, leading to the cessation of daily CRR debits.

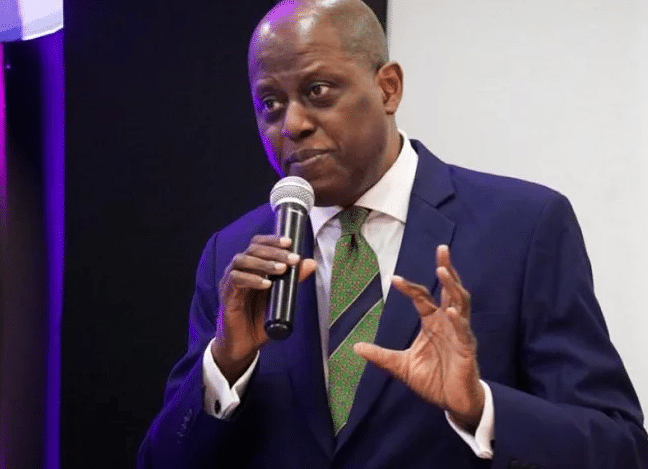

The development was confirmed in a letter signed by Ag. Director of the Banking Supervision Department, Adetona Adedeji, Naija News understands.

The CBN also urged Deposit Money Banks (DMBs) to fulfil the Loan/Deposit Ratio. In a recent communication addressed to the banks, the CBN explained that this decision aims to enhance their ability to plan, monitor, and align their records with the CBN.

Adedeji outlines that the determination of the deposits subject to sterilization with the CBN as CRR will now involve two processes.

The first phase involves the utilization of the Incremental Approach, where the existing ratios (32.5% for commercial banks and 10% for merchant banks) will be applied to any increases in the banks’ weekly average adjusted deposits, the apex bank noted.

In the second phase, banks that fail to meet the minimum Loan to Deposit Ratio (LDR) will be subject to a CRR levy of 50% of the lending shortfall.

This requirement was communicated to all banks in a correspondence referenced BSD/DIR/GEN/LAB/12/049 dated September 30, 2019.

The apex bank said it will furnish banks with comprehensive information regarding the imposed charges and the reasoning behind their calculation.