Nigeria News

New Naira Notes: Major Reasons Kogi, Zamfara, Kaduna Govts Dragged FG, CBN To Court

Kaduna, Zamfara and Kogi State governments on Monday, February 6, 2023, dragged President Muhammadu Buhari-led government and the Central Bank of Nigeria (CBN) to court, mentioning the Attorney-General of the Federation and Minister of Justice, Abubakar Malami (SAN), as the sole respondent in their suit.

In a motion ex-parte filed on their behalf by their lawyer, Abdul Hakeem Uthman Mustapha (SAN), the three northern states explained why they had to take legal action against the federal government.

Recall that the CBN had, after the unveiling of the redesigned N1000, N500 and N200 notes, announced January 31st as the deadline for the validity of the old notes of the three denominations.

The apex bank subsequently postponed the deadline to February 10, 2023.

However, despite chaotic events unfolding across states due to the tussle in getting the new naira notes, the CBN Governor, Godwin Emefiele, declared during a press conference held in Lagos over the weekend that the apex bank will not extend the deadline for swapping old naira notes with the newly redesigned ones.

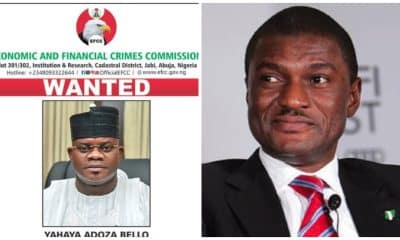

Reacting to the development, the governments of Kaduna, Kogi, and Zamfara, led by Governor Nasir El-Rufai, Yahaya Bello and Bello Matawalle, respectively, dragged the Federal government before the Supreme Court, seeking a restraining order to stop the full implementation of the policy.

Our People Find It Very Difficult To Access New Naira Notes

Stating their reasons, the Plaintiffs said that since the announcement of the new naira note policy, there has been an acute shortage in the supply of the new naira notes in their respective states and that citizens who have dutifully deposited their old naira notes have increasingly found it difficult and sometimes next to impossible to access new naira notes to go about their daily activities.

They also cited the inadequacy of the notice coupled with the haphazard manner in which the exercise is being carried out and the attendant hardship it is wrecking on Nigerians, which has been well acknowledged even by the Federal Government of Nigeria itself.

The Plaintiffs also argued that the ten-day extension by the Federal Government is insufficient to address the challenges bedevilling the policy.

February 10 Deadline Must Be Stopped

They jointly urged the apex court to grant them an interim injunction stopping the Federal Government either by itself or acting through the CBN, the commercial banks or its agents from carrying out its plan of ending the timeframe within which the now older versions of the 200, 500 and 1000 denominations of the Naira may no longer be legal tender on February 10, 2023.

In the suit, the Plaintiffs also filed a motion on notice to abridge the time within which the Respondent may file and serve his Counter-Affidavit to this Suit and an order for an accelerated hearing of this matter.

Naija News understands that the states are seeking a declaration that the Demonetization Policy of the Federation being currently carried out by the CBN under the directive of President Buhari is not in compliance with the extant provisions of the Constitution of the Federal Republic of Nigeria 1999 (as amended), Central Bank of Nigeria Act, 2007 and actual laws on the subject.

Reasonable Notice Must Be Given

They are also asking the court to make a declaration that the three-month notice given by the Federal Government of Nigeria through the CBN by the Nigerian leader, the expiration of which will render the old Banknotes inadmissible as legal tender, is in gross violation of the provisions of Section 20(3) of the CBN Act 2007 which specifies that Reasonable Notice must be given before such a policy.

The Plaintiffs are also urging the court for a declaration that given the express provisions of Section 20(3) of the Central Bank of Nigeria Act 2007, the Federal Government of Nigeria, through the Central Bank of Nigeria, has no powers to issue a timeline for the acceptance and redeeming of banknotes issued by the Bank, except as limited by Section 22(1) of the CBN Act 2007. The Central Bank shall at all times redeem its bank notes.

The Plaintiffs further want the court to direct the immediate suspension of the demonetization of the Federal Government of Nigeria through the Central Bank of Nigeria under the directive of the President of the Federal Republic of Nigeria until it complies with the relevant provisions of the law.

In an affidavit filed in support of the suit and sworn to by the Attorney General and Commissioner for Justice, Kaduna State, Aisha Dikko, she averred that although the naira redesign policy was introduced to encourage the cashless policy of the Federal government, it is not all transactions that can be conveniently carried out through electronic means.

According to her, several transactions still require cash in exchange for goods and services; hence the Federal Government needs to have sufficient money available in circulation for the smooth running of the economy.

Dikko also pointed out that the Federal Government has embarked on the policy within a narrow and unworkable time frame, and this has adversely affected Nigerian citizens within Kaduna, Kogi and Zamfara States as well as their Governments, especially as the newly redesigned naira notes are not available for use by the people as well as the State Governments.

“That the majority of the indigenes of the Plaintiffs’ states who reside in the rural areas have been unable to exchange or deposit their old naira notes as there are no banks in the rural areas where the majority of the population of the states reside.

“Most people in rural areas of the Plaintiffs’ states do not have bank accounts and have so far been unable to deposit their life savings which are still in the old naira notes,” she said.

According to Dikko, there is restiveness amongst the people in the various states because of the hardship being suffered by the people, noting that the situation will degenerate into the breakdown of law and order sooner than later.

She added: “The Plaintiff State Governments cannot stand by as they are duty-bound to protect citizens in their states and prevent the breakdown of law and order.

Intervene, Else Kaduna, Zamfara, Kogi People Will Suffer More Loss

Dikko stressed further that if the Federal Government of Nigeria had given sufficient and reasonable time for the naira redesign policy, all the current hardship and loss being experienced by the Plaintiffs’ State Governments and people in the various states would have been avoided.

She begged the court to intervene in the ongoing crisis, or else citizens of the states mentioned in the suit will suffer more losses.

She said: “I know that the 10-day extension by the Federal Government is still insufficient to address the challenges bedevilling the policy. I also understand that the Federal Government cannot bar Nigerians from redeeming their old naira notes at any time, even though the senior notes are no longer legal tender.

“Unless this Honourable Court intervenes, the Government and people of Kaduna, Kogi and Zamfara State will continue to go through a lot of hardship and would ultimately suffer great loss as a result of the insufficient and unreasonable time within which the Federal Government is embarking on the ongoing currency redesign policy,” she stated.

No date has been fixed for the hearing of the suit, Naija News understands.