Nigeria News

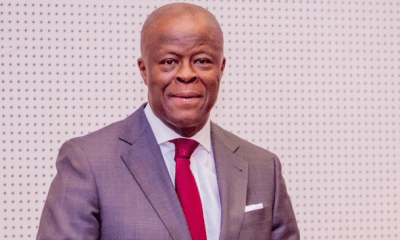

Emefiele And The New Naira Snafu, By Bright Okuta

I was a guest on Nigeria Info Radio Abuja on January 23. I spoke on topics related to the 2023 election, its unfolding drama and intrigues; the plot twists and dynamics. I also spoke on the controversy around the Central Bank Governor, Godwin Emefiele, and the snafu surrounding the New Naira notes.

I maintained my position that it is impossible for Nigerians, especially those in rural areas to meet the deadline of submitting old notes before January 31. Quite a lot of people in rural areas are not even aware that the government has redesigned the currency. And those who are aware have no access to financial institutions to deposit their money. In Yobe state for example, only four local governments out of 17 local governments have banks. It would cost as much as ₦2,000 to ₦5,000 for people in rural areas to travel to areas where there are banks to have their monies deposited.

The official deadline by which the old notes cease to become legal tender is in four days. The CBN has claimed there are sufficient new notes in circulation, and that the Deposit money banks have enough to give to customers. On the flip side, banks claim there are insufficient new notes available to them, and it is why Nigerians still withdraw old notes from ATMs despite depositing them in the bank. Many have complained that they deposited old notes in the bank, and then withdrew the same from the ATMs. What is the point of depositing them if you still have to withdraw from ATMs?

At the Point of Sale stands, operators still give out old notes. They claim banks still issue that because they do not have enough new notes to give out yet. They were told by banks that the low circulation of the new notes was the fault of the CBN. The CBN has made little effort to ensure the proper distribution of these redesigned currencies.

I was in one of the banks on Wednesday, January 25. I had a chat with the customer service staff present. She explained to me that the CBN has not made enough provision for new notes yet. And that is why deposit money banks are still giving out old notes. The most they could do was to mix both the old notes and the few new notes available with them. She claimed less than 20% of the new notes are available in banks and in circulation too.

This mixup points to many problems, but most fundamentally, the lack of synergy between the central bank and deposit money banks. Unsurprisingly so, it is a common style in the Buhari administration. Recall that in October 2022, the Finance minister, Zainab Ahmed came out publicly to say she knew nothing about the new Naira redesign. She claimed her ministry, the ministry of finance, was not aware that a decision was made to change the naira, and therefore she was against the policy. The ministry that oversees the financial assets of the government and controls its revenue was not aware of such an important decision. This explains more than a lot, the haphazard and chaotic fashion in which the administration operates, and also the lack of synergy between government agencies, parastatals and ministries.

The CBN launched the Cash Swap on Monday, January 23, eight days before the deadline. The programme is intended to increase the speed of circulation of the new notes mostly in rural areas ahead of the 31st January deadline. How effective can this be, considering the few days left and the large population of rural dwellers in Nigeria, especially in the Northern part of the country? Would these programme reach every rural area in Nigeria under eight days? What are the modalities put in place to achieve this in just eight days?

Emefiele may have to rethink this decision by adjusting the deadline. Beyond the politics this hasty decision to redesign the Naira is alleged to have been connected to, ordinary Nigerians are the ones to bear the brunt.

Twitter: @brightokuta

[email protected]