Nigeria News

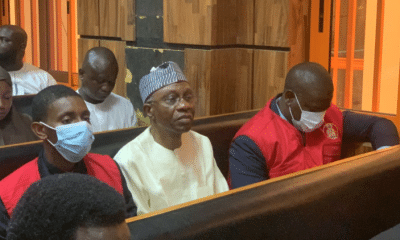

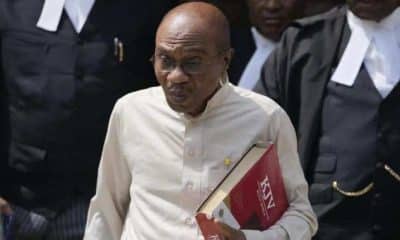

VIDEO: Emefiele Makes Final Stance On Old Naira Notes’ Deadline After Senate’s Directive

The Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, has said that there is no going back on the date set to withdraw the legal tender status of the old naira notes.

Emefiele made this known on Tuesday during the first Monetary Policy Committee meeting of 2023 after the Senate’ bid to extend the deadline for the circulation of old naira notes by six months.

Emefiele said that 90 days is enough for everyone who still has the old currency to deposit it in the banks.

He said: “Unfortunately, I don’t have good news for those who feel that we should shift the deadline. My apologies. The reason is because just like the President has said on more than two occasions and even to people privately, for us 90 days or 100 days we feel is enough for anybody who has money or old currency to deposit it in the banks.

“We took every measure to ensure that all the banks were open or remain open to receive the old currencies. One hundred days we believe is more than adequate. We called on the banks to extend banking hours and keep doors open on Saturdays. The banks did not have any reason to even keep their banking halls open on Saturday neither did they see the kind of rush. It was the normal people who came and deposited in the banks.

“We do not see any need to talk about a shift because people could not deposit their old money into their banks. About the circulation of the new currency, we said the currency was available.”

According to him, the apex bank stopped banks from paying new notes over the counter because they were not paying to the vulnerable people that needed the new notes.

He said banks “paid new notes to their friends. We told the banks to fill their ATMs with new notes and do not put in old notes again. We increased the volume of disbursement of new notes to the banks and at some points, we told banks to reduce the volume of old notes in their banks at a certain percentage because on the first you should have zero old notes in their vaults.”

He lamented that in 2015, N1.42trn was in circulation, but the figures jumped to N3.23trn in 2023.

According to him, N1.7trn out of the N3.23trn is outside bank vaults. “It has made the efficacy of monetary policy difficult,” Emefiele revealed.