Cryptocurrency

FTX Crash Will Spring Up Intense Government Regulations On Cryptocurrency

Several entities numbering above 150, including FTX.com, Alameda Research, and FTX US, filed for bankruptcy last weekend following the Insolvency of FTX.com, which resulted in the drastic decline in the value of its native token $FTT. – SBF CEO of FTX filed for Chapter 11 Bankruptcy for FTX, Alameda Research and others.

BlockFi has also gone bust, thus announcing limitations on Withdrawals and other Platform functions will be halted until clear direction on the FTX/Alameda Research Crisis.

Amidst FTX’s face-off, Crypto.com showed that more of their customer deposits are in Shiba Inu Token than Ethereum on its latest released Proof of Reserves.

Key takeaway from FTXCRASH:

Governments will step in with HEAVY regulations, introducing CBDC with UNIQUE wallets linked to Identity Cards. We can still make money, but taxes and new rules will make it harder for retail money.

Cryptocurrency will fall under serious SEC and CBDC regulations, MT GOX exploited the space Eight (8) years ago the inside story of Mt. Gox, bitcoin’s $460 million disaster, however, the Crypto Industry survived that impasse. Crypto in general, will face Stiff Scrutiny and intense Criticism in the coming months – SBF was trying to enable congress overhang by going after Decentralized Finance (DEFI) and forming monopolistic arrangements, which will see FTX champion Crypto Sovereignty across the globe, unfortunately, he’s running an entity strictly on Ponziconomics.

What assets do exchanges hold? And I mean tangible assets. A Bank may fail but still has e.g. Customer Debt as assets that can be the counterpoint to a bailout. No sane person or entity would bail you out when you hold Tokens whose value is 100% perception and speculation.

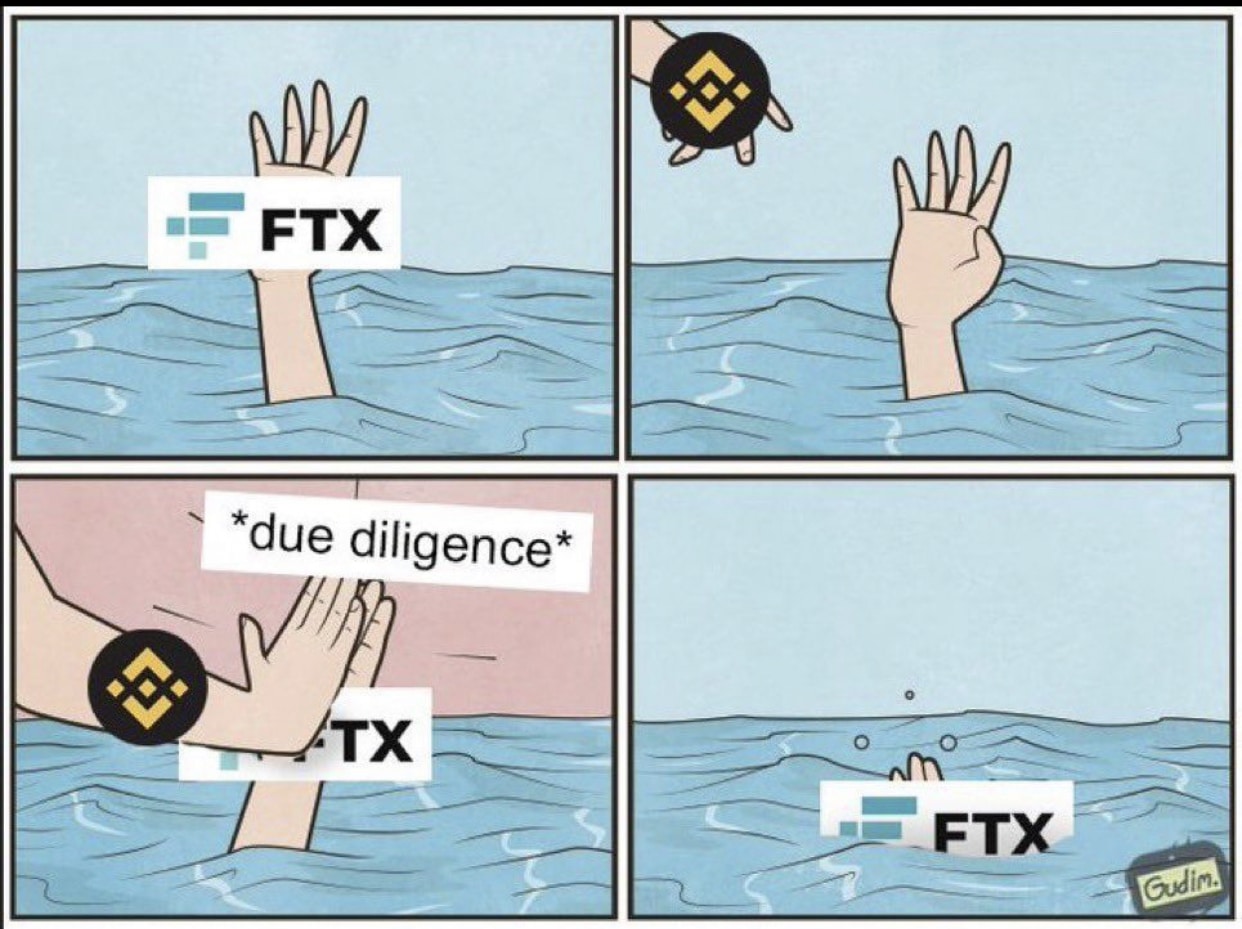

The operational practice within FTX and Alameda Research got screwed up. I have no doubt CZ-Binance saw an opportunity to aim his competitor and seized it, but I’m not sure even he knew how bad it was.

Interestingly, CZ-BINANCE is Launching a Crypto Industry Recovery Fund to help cushion the effects of uncertainties. FTX going down is not good for anyone in the industry, but it needs to be done to get scammers and manipulators off the industry.

When $FTTC, Zack Tackett, Former head of Institutional Sales at FTX is suggesting Two Formulas A/B: Bankruptcy or Issuing A consolidation Token? Alameda has over-leveraged positions, they can’t bring $FTT back to the top. At this point, I don’t think even CZ can handle the hole created by SBF’s FTX. This situation is presumably dragging other Crypto Exchanges on the part of Insolvency – Panic Withdrawals from DEXs and CEXs will lead to more catastrophic crypto crashes.

On the other hand, due to rising fears amongst Crypto enthusiasts, the campaign on Self-Fund Custody has generated increased momentum. Crypto Analysts and OGs on Twitter has relayed on the need for Cryptocurrency degenerates to save funds using a self-custody hardware interface, presumably a Ledger Nano device – thus leading to a potential increase in the transfer of funds from Centralized Entities; Binance recently tweeted about ‘Self-Custody using a Hardware Wallet’;

“Binance has industry-leading security practices to ensure that your funds are always SAFU. However, if you want to go down the route of self-custody, you can store your crypto offline through a hardware wallet”.

Going forward, the Cryptocurrency industry will face strong resentment from Institutional Investors, Crypto Users and Governments across the globe owing to the Lackadaisical attributes of SBF and Alameda Research.

Written by; Paul Ugbede Godwin. he can be reached via [email protected]