Business

CBN Lends N595.34bn To Banks In Two Months

The Central Bank of Nigeria (CBN) said it released a total of N595.34bn to commercial banks in the two months.

The apex bank said it becomes the resort for the financial institutions, adding that increased liquidity in the banking system has resulted in a reduction in the amount borrowed by the lending institutions.

The CBN released the said loans to the financial institutions between January and February, Naija News understands.

The CBN’s monthly economic report showed that while N333.59bn was borrowed through the Standing Lending Facility in January, the amount reduced to N255.75bn in February.

A financial data released by the apex bank said, “Subdued activities in the SLF window and the strong patronage at the Standing Deposit Facility confirm increased liquidity in the banking system. Activities at the standing facility window reflected ease in banking system liquidity during the review period.

“The total SDF increased significantly by 60.79 per cent, to N472.38bn, from N293.79bn in January 2022. Conversely, transactions at the SLF decreased by 24.69 per cent, to N255.75bn, from N339.59bn in January 2022.”

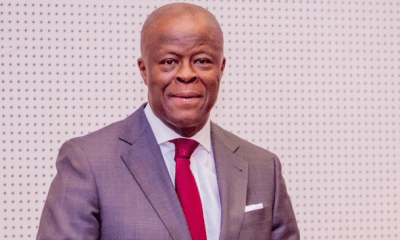

A former President, Association of National Accountants of Nigeria, Dr Sam Nzekwe, said banks borrow from the CBN as a lender of last resort.

According to him, the banks also keep part of their savings with the CBN.

He said, “The banks have to take from the CBN because it is the bank of the last resort. CBN is also keeping part of their money which they cannot lend.”

Speaking earlier on liquidity in the sector during the period after a Monetary Policy Meeting, the CBN Governor, Godwin Emefiele, had said members noted that the growth rate of broad money supply (M3) increased to 2.12 per cent in February 2022, compared with 1. 74 per cent in January 2022.

The development was largely attributed to an increase in the growth rate of Net Domestic Assets to 5.78 per cent in February 2022 from 2.62 per cent in the previous month.

“On the developments in the money market, the Committee observed the movement in money market rates around the asymmetric corridor, reflecting the prevailing liquidity conditions in the banking system.

“Accordingly, the monthly weighted average Open Buyback and Inter-bank Call rates decreased to 5.81 and 9.30 per cent in February 2022 from 6.00 and 16.00 per cent in January 2022, respectively. The decrease in the rates reflected the liquidity conditions in the banking system,” Emefiele noted.