Naija News Partners

Stellas Digital Bank Goes Live With ‘The Ghost Mode’ Feature

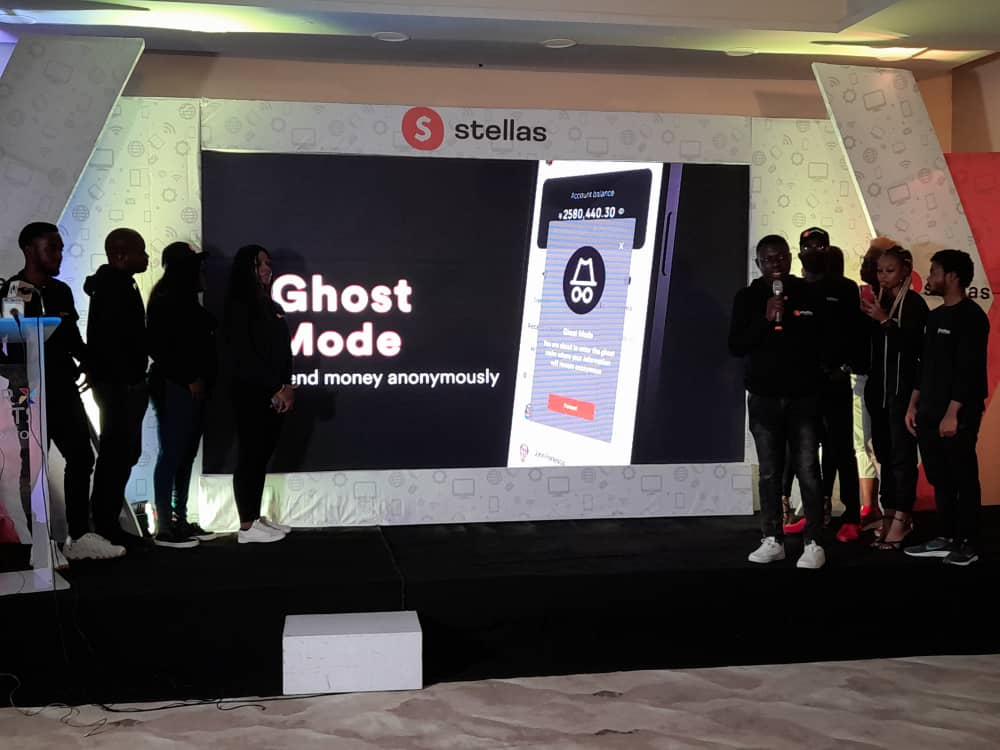

The tech community is set to experience major disruption with the launch of Stellas Digital Bank, an online bank with a new App featuring the Ghost Mode, a unique banking offering.

The Ghost Mode allows users to transfer funds to beneficiaries or make payments incognito.

This service meets the yearnings of many users who want to make payments confidentially or donate to a cause, occasion, event and exercise a humanitarian gesture anonymously.

The launch of the new App, which saw many experts in the tech industry grace the occasion, was held at Four Points By Sheraton, Victoria Island, Lagos, Naija News reports.

Bukola Olutayo

Speaking to the event, Bukola Olutayo, Stellas Digital Bank Managing Director, pointed out that the pace of growth with internet adoption in sub-Saharan Africa is one of the fastest globally.

According to him, over the last few years and especially since the Covid 19 pandemic, the world have experienced rapid expansion in the use of digital technology across society and the economy to do things previously thought impossible.

He stated that the features of the new mobile application include the Ghost Mode, Automated deposits and Budgeting tool.

Olutayo said: “The “ghost mode” is a unique feature in the fintech space that prioritizes user identity protection and complements the lifestyle of discerning customers.

“Automated deposits and the budgeting tool are features critical for a healthy saving/spending culture, fundamental to long-term wealth creation.”

Also speaking on the Ghost Mode feature, the company’s Chief Technology Officer (CTO), Anselem Uba said the feature is guaranteed to revolutionize customer experience and breed a whole new community of what he described as “Anonymous Angels.”

“Beyond this, the feature ultimately protects Stellas Digital Bank customers by encrypting their transactions and isolating them from fraudsters,” he said.

According to Uba, Automated Deposit allows users to transfer funds from any bank account into the Stellas app without manually transferring from one bank into the other.

He said this saves them the rigours of deploying several Apps in other to perform a transaction, thereby creating convenience, speed and efficiency.

“The Budgeting tool is a helpful feature released on the Stellas app, enabling users to plan and allocate funds to monthly expenditure similar to how individuals conventionally make a list of how to disburse monthly income. One of the benefits of the Budgeting tool is the ability to compare their actual spending to the budget real-time and periodically, keeping users in check on spending habits”, the CTO noted.

Uba added that the App bouquet also allows users to request loans online, with a pre-set risk management policy to notify applicants on loan eligibility.

Naija News understands that Stellas Digital Bank is fully licensed by the Central Bank of Nigeria (CBN), and has all its accounts insured by Nigeria Deposit Insurance Corporation(NDIC).

Complete digitization of Stellas Bank’s processes means customers on its platform will be able to conduct transactions in real-time and get much-needed support online.

Beyond the anticipated disruptions, Stellas Digital Bank will offer the lowest transaction charges in the industry, with a cost not exceeding N10 per transfer.

Bank on the move, the challenger bank’s new tagline restates its promise of simplicity, style, and convenience in service delivery.