Business

CBN Proposes N100 Billion New Minimum Capital Base For Commercial Banks

The Central Bank of Nigeria (CBN) has proposed an increase in the minimum capital base for commercial banks in Nigeria to one hundred billion naira.

Naija News recalls that the apex bank gave the revelation yesterday while presenting his five-year term agenda.

The Governor of the CBN, Mr Godwin Emefiele, has explained that the current capital base of the banks are no longer realistic, principally because of the massive devaluation of the Naira since the benchmark was set about 10 years ago.

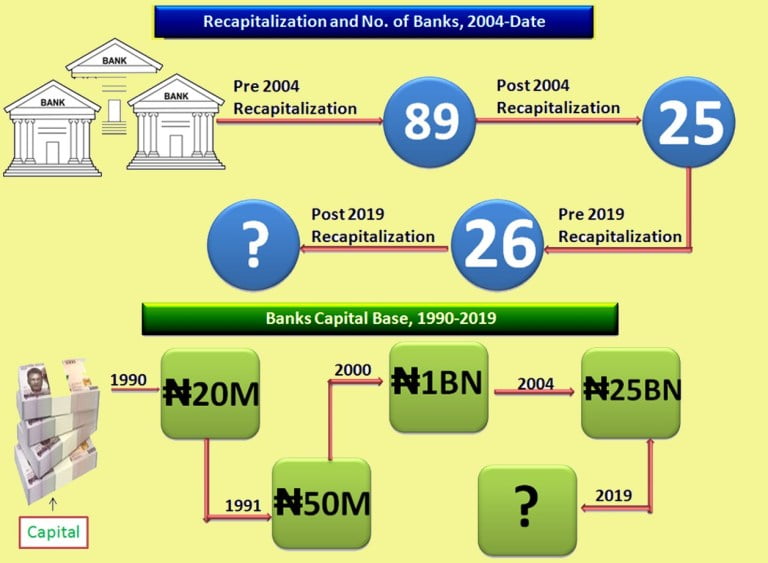

The apex bank under Lamido Sanusi as governor had pegged minimum capital base of banks at N15 billion (US$113 million at exchange rate of USD/132.85 then) for Regional Licence, N25 billion (US$188m) for National Licence and N100 billion (US$753m) for International Licence.

But at current exchange rate, the value of the Regional Licence has gone down to US$49 million from US$113 million, while National Licence is now down to US$82million from US$188 million with the International Licence down to US327.9 million from US$753 million.

Fitch expresses concern over FG’s ability to support banks(Opens in a new browser tab)

Though Emefiele had indicated that the apex bank was looking at benchmarking with the Investors & Exporters, I&E forex window rate of USD/360, the apex bank may use the official rate of USD/305 to minimise the immediate impact on the banks.

Consequently, barring other considerations, at current official exchange rate of USD/ 305 the value of Regional Licence would be N35 billion, up 133 per cent from N15 billion, while that of National Licence would be N57.3 billion, up 128 per cent from N25 billion and International Licence at N230 billion, up 130 per cent from N100 billion.

On the percentage point increase, Chukwuma Soludo’s capital base adjustment was at 1,150 per cent to N25 billion from N1billion, while Joseph Sanusi, the CBN Governor before Soludo, had effected a 1,900 per cent increase.

Emefiele had stated: “In the next five years, we intend to pursue a programme of recapitalising the banking industry so as to position Nigerian banks among the top 500 in the world. Banks will therefore be required to maintain higher level of capital, as well as, liquid assets in order to reduce the impact of an economic crisis on the financial system.

“It was Governor (Chukwuma) Soludo, in 2004 who did the last recapitalisation we had, moving the capitalisation from N2 billion to N25 billion.“I must commend that effort because it resulted in positioning Nigerian banks, not only in Africa, but to become among top banks in the world, in terms of capitalisation.

“It also helped strengthen the banks to take on large transactions and those are the things they badly needed. “Today, when you relate N25 billion in 2001 exchange rate, which was about N100/$1, N25 billion was about $200 million. Today if you relate N25 billion at N360/$1, you can see that it is substantially lower than $75 million.

“What we are trying to say is that the capitalisation has weakened quite substantially and there is need for us to say it is time for us to recapitalise Nigerian banks again.

“It is a policy thrust which will be discussed at the Committee of Governors’ Meeting and of course, the framework for the recapitalization of Nigerian banks would be unfolded for the whole world to know.”

The governor said that in the next five years, his team would work closely with the fiscal authorities to ensure macro-economic stability, double-digit growth, single-digit inflation and greater access to finance for businesses.