Nigeria News

FG Set To Take Over Onnoghen’s Bank Accounts

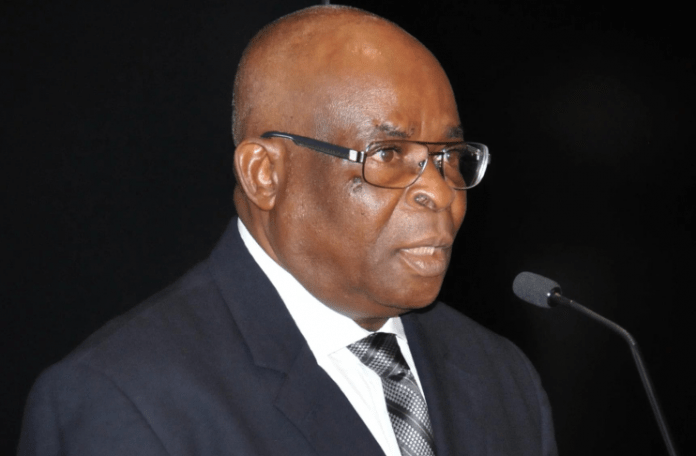

The Federal Government will, on Tuesday, start the process of taking ownership of the five bank accounts lost by the former Chief Justice of Nigeria, Justice Walter Onnoghen, following his conviction last Thursday by the Code of Conduct Tribunal.

The CCT had, on Thursday, convicted Onnoghen on charges of breach of the Code of Conduct for Public Officer by failing to declare as part of his assets the five accounts domiciled at the Wuse 2, Abuja branch of Standard Chartered Bank (Nig,) Limited.

The tribunal had convicted the former CJN on six counts including a specific allegation that he failed to declare his assets to the Code of Conduct Bureau between June 2005 and December 14, 2016.

It also convicted him on five other counts in which he was alleged to have falsely declared his assets on December 14, 2016, by omitting to declare his domiciliary dollar, euro and pound sterling accounts as well as two naira accounts as his assets.

Imposing the punishment for the alleged offences, the three-man tribunal, led by Danladi Umar, ordered Onnoghen’s removal as the CJN, and as the Chairman of both the National Judicial Council and the Federal Judicial Service Commission.

It also banned him from holding any public office for a period of 10 years.

The tribunal also ordered the forfeiture of the funds in the five bank accounts which the defendant was said to have failed to declare as part of his assets in breach of the Code of Conduct for Public Officers.

Although the tribunal did not mention the amount in the accounts, calculations of the balances in the accounts released as part of the prosecution’s evidence in the course of the trial show that the total amount to be forfeited is over N46m.

The prosecuting counsel, Mr Umar Aliyu (SAN), confirmed to Punch on Saturday that the tribunal would draw the order for forfeiture of the accounts from its judgment and the Federal Government would have it served on the bank, Standard Chartered Bank (Nig.) Ltd, on Tuesday.

He noted that without the service of the order of forfeiture on the bank, the Federal Government would not be able to take ownership of the accounts as ordered by the CCT.

He said, “The order of the court will have to be served on the bank.

“In line with the judgment of the tribunal, an order will now have to be drawn from the judgment to the effect that the money in the accounts should be forfeited to the Federal Government.

“Without that, the bank will not accede to any request by the Federal Government for the forfeiture of the accounts.

“We expect that after the Easter break (which ends on Monday), the order will be drawn up by the tribunal and would be subsequently served on the bank.”

The Head, Press and Public Relations Unit of the CCT, Mr Ibraheem Al-Hassan, also confirmed to Punch that the order would be ready for service on the bank on Tuesday.

He explained that the order had not been drawn up from the judgment because there was no time to do so since the verdict was delivered late on Thursday, the last working day before the Easter break started on Friday.

Al-Hassan said, “The order would be ready by Tuesday. If you recall, the judgment was delivered late into the closing time on Thursday; so, there was no time to draw the order from the judgment. Friday and Monday are public holidays.

“So, the next workday is Tuesday. By Tuesday, the order will be ready for service.”

Only one of the senior lawyers that defended Onnoghen during the trial could be reached on Saturday as the telephone of others rang out or no connection could be established with them.

But the senior advocate that was reached said he could not speak on the matter since he was not in the country when the judgment was delivered.

While giving evidence as to the third prosecution witness in the trial on March 21, an official of Standard Chartered Bank, Ifeoma Okeagbue, had given the details of the balances in the five accounts of ex-CJN.

Okeagbue, the Team Leader, Priority Banking as well as Onnoghen’s Relationship Manager at the branch of the bank in Wuse 2, Abuja, said all the bank accounts were still active as of the time of her testimony.

The banker said the accounts, opened separately between 2009 and 2010, were in euro, pounds, dollar and naira denominations.

According to her, the balance in the Euro account number 5001062686, as of December 2018 was €10,187.18. At N404 per €, this amounts to ₦4,115,620.72

She said for the Naira account, with number 5001062693, had N12,852,580.52 as its balance as of December 2018.

She said the Pounds Sterling account, with number 5001062679, had as its balance as of December 2018, the sum of £13,730.70. This translates to ₦6,411,910 at N467 to £1.

The second Naira account with the number, 0001062667, was said to have had a balance of ₦2,656,019.21 as of December 2018.

The witness also said the dollar account numbered 0001062650, had the balance of $56,878 as of January 2019. At the exchange rate of 1$ to N365, the balance translates to N20,476,080.

The naira equivalents of the proceeds in the accounts amount to N46,512,210.45.